This month, CHU Underwriting Agencies highlights the rising concern of underinsurance.

Increases in the cost of living and the cost of doing business is hitting Australians from every angle. Whether it is from labour shortages, supply chain issues, the energy crisis or the increase in frequency and severity of catastrophic weather events – there is currently no sign of it easing soon.

While government and regulators put their strategies and actions into play to stabilise the situation, the risk of being underinsured has become a real concern for property owners.

Underinsured is different to ‘uninsured’. It occurs when your insurance policy does not adequately cover the full value of your property. Across Australia, strata insurance is mandatory for nearly all strata buildings so while the risk of being uninsured is usually not a concern, however the external factors mentioned have impacted the number of property owners who are finding themselves significantly underinsured.

How has this risk of underinsurance arisen?

Strata property owners are more likely to find themselves underinsured if they have not reviewed their policy sum insured or had their property valued in the last 12 months.

Underinsurance occurs when the sum insured on your present policy does not cover the full value to repair or replace what you have covered. This relates to both the value of your property increasing (asset creep) as well as how long since you have updated your sum insured on your policy and when the last time you conducted a valuation.

External factors have also impacted the strata industry as mentioned above, the rising cost of building materials, labour shortages, supply chain issues and lack of available resources for repairs and remediation of buildings.

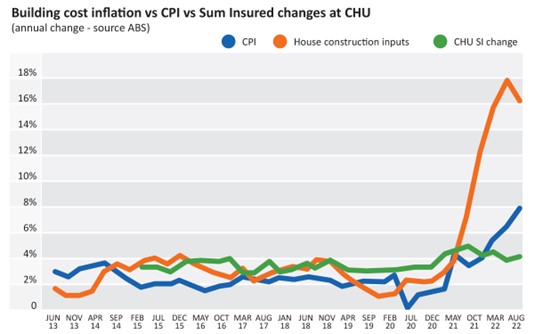

The graph below shows how quickly the cost of construction materials has risen and how this is well outpacing CPI over the past few years. When overlayed with CHU’s actual sum insured changes across the portfolio it is clear that there is a discrepancy, and the gap is growing.

Source: Australian Bureau of Statistics and CHU data to June 2022.

Why is the risk of underinsurance so concerning to strata insurers?

With the increase in severity and frequency of catastrophic events, CHU wants owners to take this risk of uninsurance seriously.

In general, your strata building insurance should:

- Insure for full replacement and reinstatement value;

- Include removal of debris, professional fees and an allowance for cost escalation over a period of time.

In most states and territories, there is a requirement to obtain a valuation at least once every five years. But with the sharp increase in costs, along with increase in the value of most property across Australia, owners who have not had a valuation in the last 12 months are likely to find that their sum insured is insufficient and could leave them out of pocket should an unexpected event occur.

Even when a owners’ corporation* thinks it has adequately calculated appropriate replacement costs, unexpected shortfalls can still arise.

What should strata property owners do to avoid the risk of underinsurance?

Insurance is all about peace of mind and providing safeguards in case of major or minor incidents and unfortunately, these events are on the rise.

CHU recommends owners should:

- Get an up-to-date valuation on their property.

- Update their sum insured to reflect the full replacement cost of their property factoring inflation and rising cost of materials.

- Ensure they have safeguards within their policy including allowances for removal of debris, demolition and professional fees.

Limiting the risks and costs

Aside from the above considerations, owners’ corporations should regularly assess their maintenance schedule of the building and keep it up to date. Maintenance such as servicing machinery, cleaning and clearing garden waste from the property and gutters and checking that their building meets fire and safety compliance checks on a regular basis.

Many insurers such as CHU suggest an increase in the building sum insured called “indexation” at time of renewal to help keep pace with the rising costs. However, with the current rate of inflation and disparity with sum insured levels, owners need to take action to safeguard themselves from the risk of underinsurance.

Residential Strata ownership can be complicated, but CHU can help navigate these complexities and ensure that you have the right strata cover in place.

Disclaimer: CHU Underwriting Agencies Pty Ltd (ABN 18 001 580 070, AFS Licence No: 243261) acts under a binding authority as agent of the insurer QBE Insurance (Australia) Limited (ABN 78 003 191 035, AFS Licence No: 239545). Terms, conditions, limits, deductibles and exclusions apply to the products referred to above. Any advice in this article is general advice only and has been prepared without taking into account your objectives, financial situation or needs. Before making a decision to acquire any product(s) or to continue to hold any product, we recommend that you consider whether it is appropriate for your circumstances and read the relevant Product Disclosure Statement (‘PDS’), Financial Services Guide (‘FSG’) and the Target Market Determination (‘TMD’) which can either be viewed at www.chu.com.au or obtained by contacting CHU directly on 1300 361 263.

* The Owners’ Corporation also known as: Body Corporate, Strata Company or Strata Corporation.